Achieving financial well-being requires careful planning, budgeting, and smart money management. A budget planner can be your trusted companion in taking control of your finances and working towards your financial goals. With its comprehensive features and tracking mechanisms, a budget planner empowers you to create a realistic budget, monitor your expenses, and make informed financial decisions. In this article, we will explore the benefits of using a budget planner and how it can enhance your financial well-being.

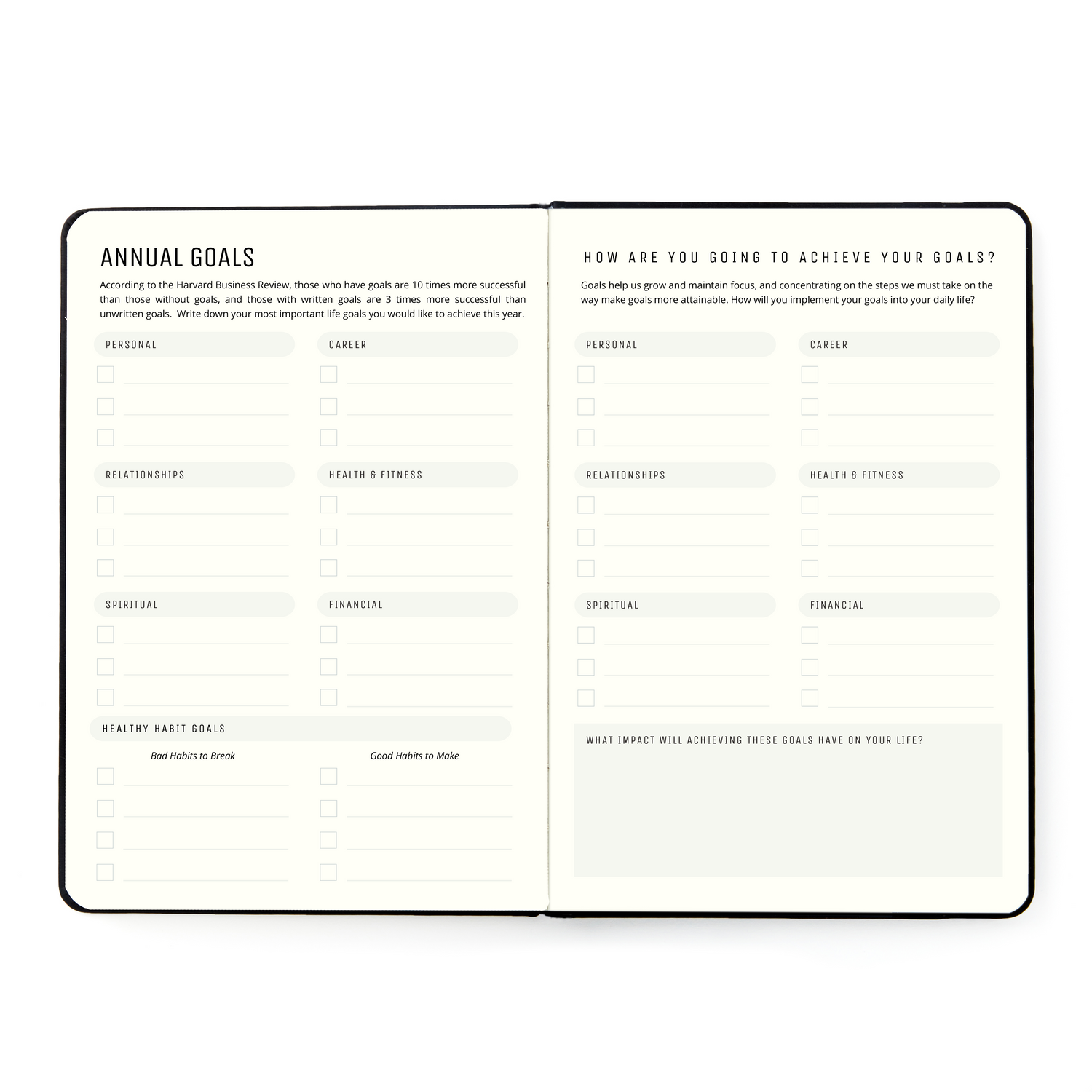

Create a Realistic Budget

A budget planner provides a designated space to create a realistic budget that aligns with your financial goals and priorities. By assessing your income, fixed expenses, and discretionary spending, you can allocate your money effectively. The planner helps you set aside funds for savings, investments, debt repayment, and other financial objectives. By having a clear budget in place, you gain control over your finances and make intentional decisions about your money.

Track and Categorize Expenses

Tracking your expenses is essential to understand your spending patterns and identify areas where you can save. A budget planner enables you to record and categorize your expenses. You can track both fixed expenses (such as rent, utilities, and loan payments) and variable expenses (such as groceries, entertainment, and dining out). The planner allows you to visualize your spending habits, making it easier to identify areas where you can cut back or make adjustments.

Monitor Savings and Debt Repayment

Building savings and reducing debt are key components of financial well-being. A budget planner provides a framework for monitoring your savings progress and debt repayment efforts. You can set savings goals and track your savings contributions. Additionally, the planner helps you track your debt balances and plan strategies for paying off debt efficiently. By monitoring your savings and debt repayment, you stay motivated and focused on achieving your financial goals.

Plan for Financial Goals and Investments

A budget planner allows you to plan for future financial goals and investments. Whether it's saving for a down payment on a house, starting a business, or investing for retirement, the planner enables you to allocate funds towards these goals. You can set specific targets, track your progress, and adjust your budget accordingly. By incorporating your financial goals into your budget planner, you create a roadmap for achieving them.

Identify Opportunities to Save and Cut Expenses

A budget planner helps you identify opportunities to save money and cut unnecessary expenses. By analyzing your spending habits, you can pinpoint areas where you can reduce costs or find more affordable alternatives. The planner encourages you to be mindful of your spending decisions and make conscious choices that align with your financial goals. By making small adjustments, you can accumulate significant savings over time.

Stay Accountable and Motivated

Accountability is crucial when it comes to sticking to a budget and achieving financial well-being. A budget planner serves as a tool for accountability, allowing you to track your progress, review your budget, and make adjustments as needed. The planner keeps you motivated by visualizing your financial goals and providing reminders of the importance of staying on track. By staying accountable and motivated, you set yourself up for long-term financial success.

Gain Financial Awareness and Confidence

Using a budget planner enhances your financial awareness and confidence. By actively engaging with your budget, you develop a better understanding of your income, expenses, and overall financial picture. This awareness empowers you to make informed financial decisions and take control of your financial future. With each successful budgeting milestone, your confidence in managing your money grows, paving the way for a secure financial future.

Conclusion

In conclusion, a budget planner is an invaluable tool for enhancing your financial well-being. By creating a realistic budget, tracking expenses, monitoring savings and debt repayment, planning for financial goals, identifying saving opportunities, staying accountable, and gaining financial awareness and confidence, a budget planner empowers you to take control of your finances and work towards a more secure financial future.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.